What is decentralized finance (DeFi)?

As the world becomes increasingly digitized, more and more of our lives are being conducted online. From banking and investments to shopping and entertainment, there’s hardly an aspect of our lives that isn’t taking place in some virtual space. This is thanks to the efficiency and security of decentralized finance (DeFi), which is revolutionizing how we manage our money. Here’s a look at what DeFi is and why it’s the future of finance. Lets dig deep into what makes DeFi different from Centralized finance.

Is Centralized Finance Different From Decentralized Finance?

Centralized finance is the traditional financial system that we’ve been using for centuries. It’s based on centralized institutions, like banks and governments, that control our money and our transactions. These institutions are often opaque and unaccountable, which can lead to inefficiencies and security risks.

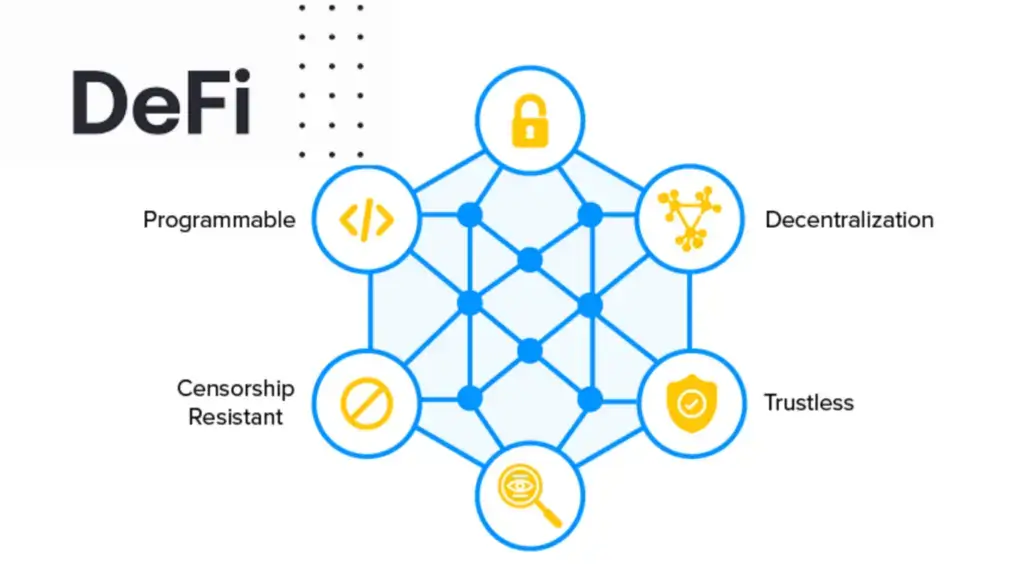

Decentralized finance, on the other hand, is a new way of managing our finances that doesn’t rely on central institutions. Instead, it uses decentralized technologies, like blockchain, to provide a more secure, transparent, and efficient way of conducting financial transactions. DeFi is often compared to the early days of the internet when there was no central authority controlling how we communicated or exchanged information.

Just as the internet decentralization created a more open and accessible world, DeFi is doing the same for our financial system.

Risks and Benefits of centralized finance

A few risks are associated with centralized finance, such as the potential for fraud or theft. In addition, because centralized financial institutions have complete control over your money, they can theoretically do whatever they want. This includes losing it, investing it poorly, or using it to benefit themselves rather than their customers.

There have been numerous examples of this throughout history, one of the main reasons some people prefer decentralized finance.

Understanding Decentralized Finance (DeFi)

DeFi is a term that describes the shift from traditional, centralized financial systems to peer-to-peer finance enabled by decentralized technologies built on the Ethereum blockchain. DeFi platforms are built around the idea of decentralization and crypto-assets, which means users can trust in the security and transparency of the system while enjoying increased privacy and autonomy.

In addition, unlike traditional financial institutions, DeFi platforms are open source, meaning anyone can use them or build on them. This makes them ideal for creating new financial products and services that are more secure, efficient, and transparent than traditional banks and lenders.

How does DeFi work?

DeFi platforms use various decentralized technologies, but the most important is the Ethereum blockchain. Ethereum is a decentralized platform that runs smart contracts or computer programs that automatically execute when certain conditions are met. This allows DeFi platforms to offer a wide range of financial products and services that would be difficult or impossible to create with traditional centralized systems.

Some popular DeFi applications include lending platforms, stablecoins, and exchanges. Lending platforms like MakerDAO and Compound allow users to earn interest on their crypto-assets by lending them to borrowers. Stablecoins like Dai are pegged to the US dollar and can be used as a digital alternative to cash. Finally, exchanges like Uniswap and Kyber Network allow users to trade crypto-assets in a decentralized manner.

What are the key benefits of DeFi?

There are numerous benefits to using DeFi applications, including increased security, transparency, and privacy. Because DeFi platforms are built on the Ethereum blockchain, they benefit from the same security features. his means that your funds are stored decentralized and are not subject to the same risks as they would be if they were stored centrally.

In addition, because DeFi applications are open source, anyone can audit the code to ensure that there are no hidden malicious features. This increases transparency and gives users more confidence in the system. Finally, because Devi platforms do not require KYC or AML compliance, they offer increased privacy compared to traditional financial institutions.

What are the main risks of DeFi?

There are also a few risks associated with using DeFi applications, the most important of which is platform risk. Because DeFi platforms are built on top of the Ethereum blockchain, they are subject to the same volatility as Ethereum. This means that the value of your assets can go up or down rapidly, and you may not be able to access your funds if the platform experiences technical difficulties.

In addition, because DeFi platforms are still new and experimental, there is a risk that they may not work as intended or that bugs may be found in the code. Finally, because DeFi platforms are decentralized, no one entity is responsible for them, so users must choose reputable platforms and understand the risks before using them.

What is the role of Bitcoin in decentralized finance?

Bitcoin plays a few different roles in the world of decentralized finance.

- Bitcoin is a decentralized asset, it can be used to collateralize loans on DeFi platforms. This means you can use your Bitcoin as collateral and borrow against it.

- Bitcoin is a digital asset with a limited supply, one can use it to stabilize the value of other assets. For example, the value of Dai is pegged to the US dollar, and Bitcoin backs part of this peg. This helps to ensure that the value of Dai does not fluctuate too much.

- Bitcoin is one of the most popular and well-known cryptocurrencies, it acts as a reserve currency for the DeFi ecosystem.This means you can use it to trade other assets on decentralized exchanges and collateralize loans.

DeFi is a rapidly growing sector of the cryptocurrency ecosystem that offers a wide range of financial products and services. By using DeFi applications, you can enjoy increased security, transparency, and privacy. However, it is essential to understand the risks before using any DeFi platform, as they are still new and experimental.

In addition, bitcoin plays a few different roles in the world of DeFi, including acting as collateral for loans and stabilizing the value of other assets.

DeFi’s challenge to traditional banking

One of the critical challenges that DeFi poses to traditional banking is its decentralized nature. Because DeFi platforms are built on the Ethereum blockchain, they are not subject to the same regulations as traditional financial institutions. This means that they can offer a broader range of products and services, including those considered high risk.

In addition, because DeFi platforms do not require KYC or AML compliance, they offer increased privacy compared to traditional financial institutions. Finally, because DeFi platforms are still new and experimental, there is a risk that they may not work as intended or that bugs may be found in the code.

Future of DeFi

Decentralized finance is a growing ecosystem of financial protocols and applications built on Ethereum. By leveraging the power of smart contracts, DeFi platforms provide an alternative to traditional financial systems that is decentralized, trailblazing, and inclusive. From lending and borrowing platforms to stablecoins and tokenized BTC, the DeFi ecosystem has launched various services and assets. Over $13 billion worth of value locked in Ethereum smart contracts, it’s clear that this is here to stay.

So what does the future hold for this burgeoning ecosystem?

As Ethereum 2.0 rolls out and grows more widely adopted, we expect to see an influx of users and value into the DeFi space. With ETH staking yielding up to 10% APR and a growing number of high-yield yield farming opportunities, users will be drawn to the platform in droves. This mass influx of users will likely lead to increased demand for DeFi services and higher transaction volumes on Ethereum.

This will spur further innovation within the space as developers race to build the next extensive DeFi protocol. We can also expect to see more traditional financial institutions get involved in it as they seek to tap into this rapidly growing ecosystem. All in all, the future looks bright for decentralized finance.

With a wide range of services and assets, increasing user adoption, and growing institutional interest, DeFi is poised to take the financial world by storm.

Best decentralized exchanges

- Uniswap: A decentralized exchange for exchanging Ethereum tokens.

- Bancor: A decentralized liquidity network that allows you to convert between different cryptocurrencies.

- AirSwap: AirSwap is a decentralized exchange built on the Ethereum network that allows users to trade ERC20 tokens directly with each other.

- Kine protocol: Kine is a decentralized protocol for financial services built on Ethereum. It allows users to trade, lend, and borrow cryptocurrencies trustless and decentralized.

- Radar Relay: Radar Relay is a decentralized exchange allowing users to trade Ethereum tokens directly.

- WandX: WandX is a decentralized exchange for trading ERC20 tokens on the Ethereum network.

- BarterDEX: BarterDEX is a decentralized exchange that allows users to trade Bitcoin, Litecoin, Dash, and other cryptocurrencies directly.

Decentralized exchanges are still a relatively new concept and come with some risks. For example, because these exchanges are not subject to the same regulations as traditional exchanges, there is a greater risk of fraud and theft.

In addition, because these exchanges are decentralized, they may be subject to downtime or other technical issues. Nevertheless, decentralized exchanges offer several advantages over traditional exchanges, including increased privacy, security, and resilience. As space matures, we can expect more users to adopt these exchanges as their go-to platform for trading cryptocurrencies.